How much can i borrow with a 100k deposit

When an account has unusual activity and 22k would apply the bank notifies the government. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

How Much Can I Borrow For A Mortgage Squirrel

More USDT deposits more votes.

. How much fits behind the third row. The 5-year-old miss notched her 14th win of the season with Walter Case Jr calling the shots from the sulky all while passing the 100K level in seasonal earnings just for good measure. This provides a rough estimate of how much you can borrow for a loan.

100k deposit 500k assumed price 02 x100 for a percentage 20 deposit. How much can you borrow from your 401k. An MMM-Recommended Bonus as of August 2021.

However the actual maximum amount you can borrow from your 401k may be less depending on what your plan allows. You can borrow as much as 90 percent of your home equity. This maximum qualifier calculator will allow you to calculate how much of a home you can afford based on your annual income.

But also very high outgoings it could impact how much you can borrow. 2023 Nissan Pathfinder pricing is out including Rock Creek. Building or simply need a bigger place to call home we can help.

As leaders in the mortgage industry we have a variety of loans available and mortgage experts. While your personal savings goals or spending habits can impact your. Whether you choose real estate investing treasury securities or building a portfolio of stocks the first step is to get started to make more money.

Wealthfront offers a similar product a Portfolio Line of Credit. Borrow from 5K to 100K no monthlyon-going fees. Property price This field is required.

Some plans also have a minimum loan amount that can be requested. Every person that deposits min 50 we will select 5 and giveaway 100k Saitama to. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Borrow Business Loans Lines Instacap Loan - up to 100k Agricultural Loans. For example with a 30-year loan term 5 interest rate and 5. If you have just 25000 in assets vs.

Below are some of the best investments to grow your money. You would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards. When it comes to calculating affordability your income debts and down payment are primary factors.

By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period. Thats 1000 cash back or 1250 toward travel when redeemed through Chase Ultimate Rewards. If youre looking to maximise how much you can borrow.

Provide a 5 deposit 10k youll need to borrow 190000. If you choose a car loan with a fixed interest rate the interest rate will stay the same during the loan so you can budget how much you need to repay every month. Make a qualifying deposit of funds new to Citi between the checking and savings accounts within 20.

The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage. 100k-2499k deposittransfer -- 250 bonus. Our experts will find the mortgage thats right for you.

Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount. The SOFR rate is the Secured Overnight Financing Rate which you can see on the Federal Reserve Bank of New York website. So if your home is worth 250000 and you owe 150000 on your mortgage you.

Meanwhile pre-approval is a formal assessment of your credit background. For a limited time a checking account bonus worth up to 2000 when you open a Citi Priority Account and complete all required activities. My result came out higher than the amount I wish to borrow what now.

Provide a 15 deposit 30k youll need to borrow 160000 which is easier to achieve. Would like to compare the impact of different interest rates on the amount you can feasibly borrow. For example if you own 100K of your home and you use 50K in a reverse mortgage you now only own 50K of your home.

More USDT deposits more votes. Want to know exactly how much you can safely borrow from your mortgage lender. Toyota Sequoia Luggage Test.

Schwabs higher 100000 requirement you can access this product and borrow against up to. How much can I borrow. Your salary is certainly an important element in assessing how much you can borrow but so are a number of other factors.

Open a savings account or open a Certificate of Deposit see interest rates. 5k- 100k Min Credit. 100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit.

Earn 100k bonus points after you spend 15000 on purchases in the first 3 months from account opening. Find out how much deposit you may need when you take out a HomeStart loan. Ive never had to fill out a form when making a large deposit.

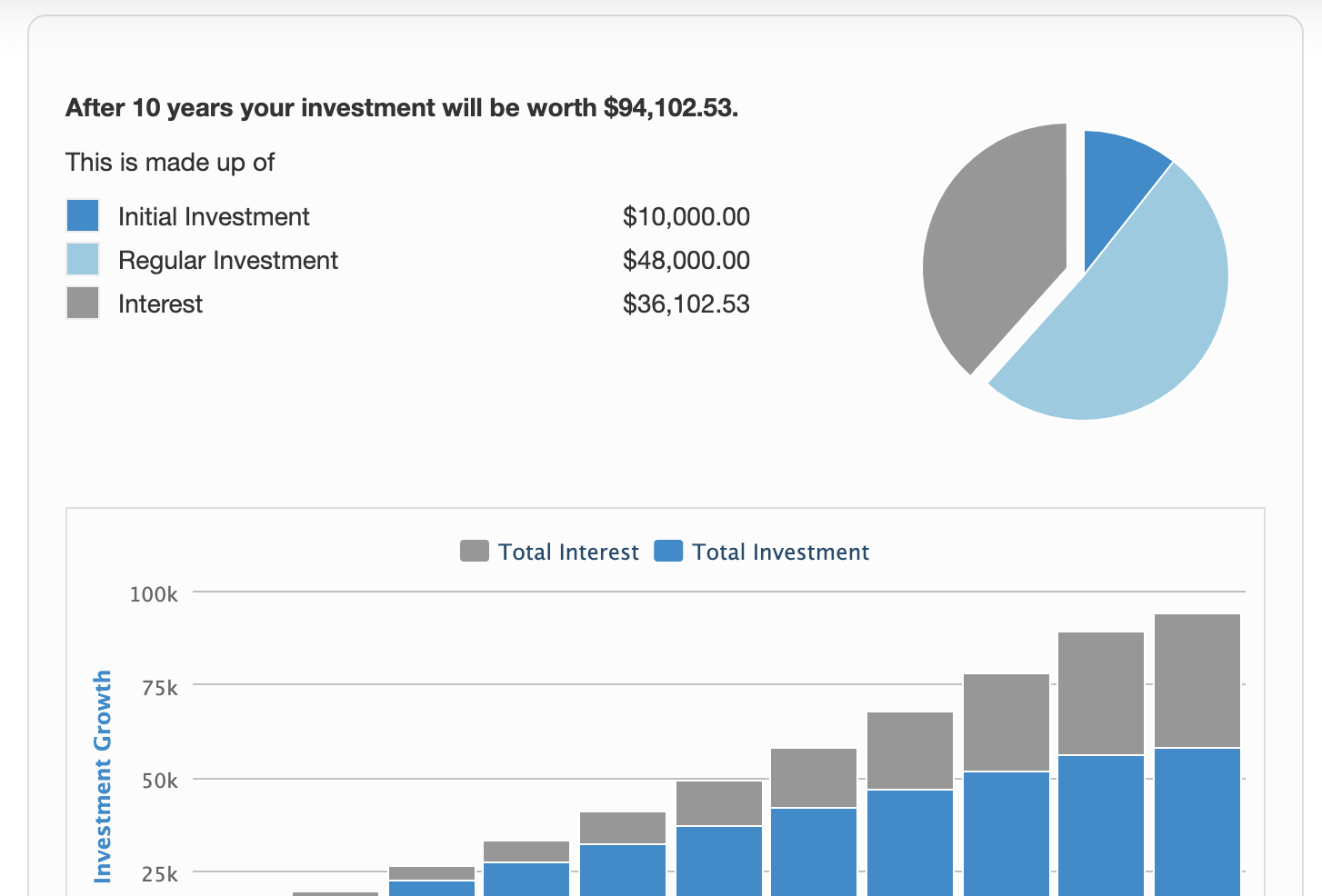

Please update your billing details here to continue enjoying your subscription. Term Deposit Calculator Credit Score Rate Checker. How Much Can I Even Borrow.

Borrowers can take out cash without worrying. Spring EQs minimum credit score is 680 and its maximum DTI ratio is 50 percent which is a draw for people with tight finances. Answer 1 of 36.

Are assessing your financial stability ahead of purchasing a property. Certificates of Deposit CD. The easiest way to attract notice is by trying to avoid being noticed.

Wealthfront Portfolio Line of Credit. What a great day to take a nice scenic and profitable mid-autumn road trip to Maine. If Im on Disability Can I Still Get a Loan.

We have roughly 24 hours to deposit USDT to Bybit_Official that you can convert to votes. First home buyer Your purchase. Receiving pre-approval is a conditional agreement from a lender to grant.

Whats a Good Interest Rate for Loans. How to Turn 10K into 100K Quickly. Open new eligible Citi Priority checking account during the offer period from July 18 2022 through Jan.

2003 Ford Crown Victoria Police Interceptor. How much can you afford. Factors that impact affordability.

Its a good indicator of whether you satisfy minimum requirements to qualify for a mortgage. The homeowner can borrow money from a lender against the value of their home and receive the funds as a line of credit or monthly payments. For example your expenses credit history any debt.

The subscription details associated with this account need to be updated.

The Number Of Consumers Living Paycheck To Paycheck Has Increased Year Over Year Across All Income Levels Lendingclub Corporation

Hermoney Podcast Episode 277 How To Make Your First 100k Hermoney

Ipad Note Inspiration Economics Notes Accounting Notes Notes Inspiration

How To Pay Off 100k In Student Loans Quora

How Much Can I Borrow For A Mortgage Squirrel

How To Access Equity Remortgaging For A Cash Lump Sum

Current Report 8 K

What S The Average Down Payment For A 500k House In California Quora

How Much Can I Borrow With A Margin Account

How Much A 450 000 Mortgage Will Cost You Credible

Calculators Archives Crown

What Mortgage Can You Get On Your Salary Find Out Here

How To Get A 100 000 Personal Loan Fast

2

2

How Much Does A Student Loan Really Affect Your Mortgage Application

How To Get A 100 000 Personal Loan Fast